FCC Investigates Exclusive Sports Streaming Deals

Locales: District of Columbia, UNITED STATES

Washington D.C. - February 25th, 2026 - The Federal Communications Commission (FCC) today announced it is significantly expanding its investigation into the rapidly growing practice of live sports broadcasts being offered exclusively through pay-TV subscription services and, increasingly, streaming platforms. What began as a preliminary inquiry into competitive impacts has escalated into a full-fledged review that could reshape how Americans access live sporting events.

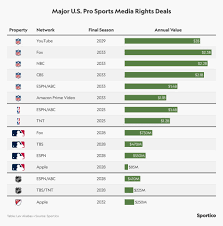

The commission's concerns center around the potential for anti-competitive behavior and dwindling consumer choice. The FCC is seeking detailed public commentary, extending the initial call for input, and now specifically requesting data on the financial implications of exclusivity deals for both consumers and smaller media providers. This heightened scrutiny comes as a growing number of major sports leagues - the NFL, NBA, MLB, and NHL - are locking down increasingly restrictive broadcast rights agreements.

For years, fans could generally rely on over-the-air broadcasts for key games, supplemented by cable and satellite options. However, over the past several years, a dramatic shift has occurred. Leagues have been aggressively pursuing lucrative contracts with companies like StreamMax, SportView+, and traditional pay-TV giants, guaranteeing exclusivity in exchange for billions of dollars. While these deals benefit the leagues and providers financially, the FCC fears they are creating a tiered system of access where fans are forced to pay a premium - often multiple premiums - to follow their favorite teams and sports.

"The rise of streaming has fundamentally altered the media landscape," stated FCC Chairwoman Evelyn Reed in a press briefing. "While we embrace innovation and competition, we have a duty to ensure that these changes don't come at the expense of consumers. The current trend of exclusive sports deals raises serious questions about access, affordability, and fairness."

The FCC is particularly focused on the impact on cord-cutters - the growing segment of the population that has abandoned traditional cable and satellite subscriptions in favor of streaming. These consumers are often priced out of accessing live sports altogether, or forced to subscribe to multiple streaming services, each with its own specialized sports package. This fragmentation is adding significantly to household entertainment costs. The commission also worries about the effect on smaller, local broadcasters who may be unable to compete with the financial firepower of national streaming giants and major pay-TV providers.

The inquiry isn't simply about whether exclusivity deals are illegal, but whether they represent a significant harm to competition and consumer welfare. The FCC is considering several potential regulatory responses, including:

- Mandating the preservation of some level of free, over-the-air access to key sporting events. This would require leagues and providers to make a certain number of games available on traditional broadcast television.

- Establishing guidelines for "reasonable" exclusivity periods. Currently, some deals extend for a decade or more, effectively locking out competition for an extended period.

- Requiring greater transparency in broadcast rights negotiations. The FCC believes that increased transparency could help to level the playing field and ensure fairer deals.

- Exploring the possibility of retransmission consent rules applying to streaming services. Currently, these rules primarily govern traditional broadcast television.

The review has already drawn criticism from both sides of the issue. Sports leagues argue that exclusive deals are necessary to fund the rising costs of production and player salaries. They point to investments in stadium upgrades, player development, and overall game quality as justification for the contracts. Pay-TV providers and streaming services contend that exclusivity is a key differentiator in a crowded marketplace and that consumers are willing to pay for premium content. However, consumer advocacy groups and smaller media companies have applauded the FCC's investigation, arguing that the current system is unsustainable and unfair.

The FCC expects to receive a substantial volume of comments from stakeholders in the coming months. A final decision is anticipated by late 2026, and could dramatically alter the future of live sports broadcasting in the United States.

Read the Full Channel NewsAsia Singapore Article at:

[ https://www.channelnewsasia.com/sport/fcc-reviews-growing-shift-live-sports-pay-tv-subscription-services-5953261 ]