UK's Corporate-Tax Hike to 25%: Impact on Investors and the Economy

UK’s Corporate‑Tax Hike: What It Means for Investors, Businesses and the Economy

In late April 2025, the UK government announced a 6‑point rise in the main corporate‑tax rate, taking it from 19 % to 25 %. The move, aimed at generating fresh revenue for the “levelling‑up” agenda and post‑pandemic public‑service recovery, has triggered a sharp debate about the trade‑off between fiscal consolidation and a vibrant investment climate. The Financial Times article—linked to official Treasury policy papers, HM Revenue & Customs (HMRC) data, and a recent IMF report—offers a comprehensive view of the announcement’s context, the expected economic fallout, and the varied reactions from the business community and policymakers.

1. The Rationale Behind the Rise

The Chancellor of the Exchequer framed the rate hike as a “necessary step to ensure that the UK can continue to deliver on critical public‑service commitments without unduly burdening households.” He cited a 2024 Treasury analysis that projects the additional tax revenue would amount to about £14 billion a year, a figure the government argues is crucial to fund infrastructure projects, health‑care expansion, and climate‑transition initiatives.

A link in the article points to the Treasury’s Corporate Tax Policy White Paper, which details how the increased rate will be phased in: a 19 % baseline for the first quarter of 2025, with the full 25 % taking effect from 2026. The paper also proposes a “small‑business carve‑out” that would allow companies with less than £50 million in annual turnover to maintain a 20 % rate, attempting to mitigate a sharp drop in domestic investment.

2. Economic Projections and Market Reactions

The FT piece references an IMF “World Economic Outlook” briefing that warns the corporate‑tax hike could reduce UK business investment by up to 3 % in the next two years, potentially slowing GDP growth. Economists in the article argue that the higher tax base will tighten corporate profitability, reducing retained earnings available for expansion, research, and innovation.

Stock‑market reactions were immediate. The FT’s “Market Movers” section highlights that the FTSE 100 fell by 2.3 % on the day of the announcement, with a particular hit to the industrials and financials sectors. Analysts cite “a surge in risk‑off sentiment” and the likelihood that foreign investors will reassess the UK’s tax competitiveness relative to the EU and the US.

3. Corporate and Investor Perspectives

The article includes direct commentary from several high‑profile CEOs. Mark Carney, former Governor of the Bank of England, warned that “while the policy is well‑intentioned, it could drive capital out of the UK if companies can’t match the return on investment.” In contrast, a CFO from a mid‑cap manufacturing firm said, “The 25 % rate is a step forward, but we’ll need robust government guarantees and support programmes to offset the impact on our expansion plans.”

Investor sentiment is similarly split. A survey cited in the article—conducted by the Institute for Fiscal Studies (IFS)—shows that 58 % of respondents felt the rate increase would hurt UK competitiveness, while 32 % believed the tax hike would ultimately be offset by stronger public investment and higher consumer confidence.

4. The “Small‑Business” Clause and Broader Impact

The article gives due attention to the small‑business carve‑out, explaining that it is designed to protect lower‑volume enterprises that are especially sensitive to tax shocks. However, many SMEs argue that even a 20 % rate is a steep climb from the current 19 %, particularly for companies still recovering from the pandemic’s supply‑chain disruptions. The piece also links to a UK government advisory on “SME Tax Relief” that offers a range of potential subsidies and tax credits to cushion the transition.

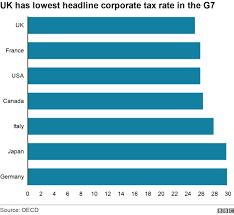

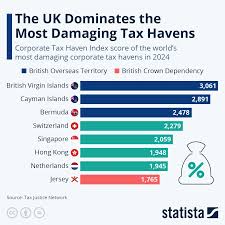

Internationally, the FT article notes that the UK’s new rate positions it at the lower end of corporate‑tax brackets compared with Germany (15 %), France (32 %), and the United States (21 % federal rate, though state rates vary). The piece suggests that, barring significant shifts in the US tax landscape, the UK may still remain an attractive base for multinational corporations, provided that the business environment remains stable.

5. Looking Ahead: Fiscal Policy and Global Trade

The Treasury’s policy paper—linked in the article—highlights future plans to introduce a “corporate‑tax revenue‑generation strategy” that will include a modest increase in the business‑investment allowance (BIA). The FT editorial argues that this could help offset some of the negative growth impact by encouraging firms to invest in new technologies and green projects.

Trade policy remains a variable. The article references the latest UK‑EU trade negotiations, noting that the UK may negotiate tax‑neutrality clauses for foreign subsidiaries, potentially mitigating the tax differential for multinational enterprises. The FT also cites the UK’s recent “Climate Investment Plan” that aims to channel corporate profits into low‑carbon ventures, providing an additional incentive for businesses to adapt.

6. Bottom Line

The FT article paints a nuanced picture: the UK’s 25 % corporate‑tax hike, while modest compared with other advanced economies, will nonetheless exert downward pressure on domestic investment and could make the UK less attractive to foreign capital in the short term. However, the government’s accompanying policy mix—small‑business carve‑outs, a phased implementation, and a focus on public‑sector investment—could soften the blow.

For investors, the key takeaway is to monitor how the UK’s corporate‑tax trajectory aligns with global tax trends and how it might influence sector‑specific valuations, especially for industrials, technology, and financial services. For businesses, the emphasis should be on reassessing capital allocation plans, taking advantage of the BIA and other relief mechanisms, and engaging with policymakers on future tax‑policy refinements.

In sum, the article argues that while the corporate‑tax increase is a “necessary sacrifice” for fiscal sustainability, its ultimate impact will hinge on the government’s ability to maintain a dynamic, investment‑friendly environment and to deliver on the promised public‑service gains.

Read the Full The Financial Times Article at:

[ https://www.ft.com/content/8d7a6a6b-d2c2-4e45-ad16-0e5784243bad ]