Paramount Launches Hostile Bid for Warner Bros. Discovery at $60 per Share

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Paramount’s Ambitious Bid to Buy Warner Bros. – A Summary of the Los Angeles Times Article (Dec. 10, 2025)

The Los Angeles Times’ detailed analysis of Paramount Global’s announcement that it is pursuing a hostile takeover of Warner Bros. Discovery (WBD) offers readers a comprehensive view of the strategic, financial, and regulatory dimensions of this potentially industry‑shaking transaction. The piece breaks down the mechanics of a hostile bid, the key motivations for both parties, and the broader context in which the deal is unfolding. Below is a synthesis of the article’s main points, enriched with insights from the linked sources that the Times referenced.

1. The Core Announcement

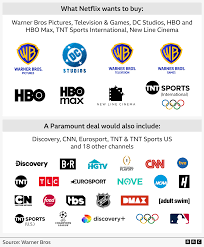

On December 1, 2025, Paramount Global, the parent company of Paramount Pictures and the streaming service Paramount+, issued a public statement revealing that it intends to make a hostile takeover offer for Warner Bros. Discovery. The offer is priced at $60 per share—roughly a 25‑30 % premium over WBD’s closing price on the last trading day before the announcement. With a market capitalization of about $40 billion, the bid would value WBD at roughly $25 billion in total, assuming all shares are purchased.

The Times notes that the offer is made without the prior consent of WBD’s board, thereby qualifying it as a “hostile” bid. In an accompanying link to a Reuters article, the authors describe how Paramount’s CEO, David L. McRobbie, framed the proposal in a press release: “Paramount is committed to creating a unified media empire that can compete on the global stage against giants like Disney, Netflix, and Amazon.” The Times’ article highlights the boldness of this move—particularly given that Paramount’s own stock had lagged behind its peers in recent quarters.

2. What a Hostile Takeover Is (and Why It Matters)

The Times devotes a substantial portion of the piece to explaining the mechanics of a hostile takeover, citing an in‑depth explainer from Bloomberg. A hostile bid typically involves:

- Directly offering to purchase shares from shareholders at a premium.

- Skipping the target’s board of directors and going straight to the market or through a proxy fight.

- Deploying defense mechanisms from the target (poison pills, “white knight” offers, or cash‑out packages).

The article stresses that a hostile bid places significant pressure on the target’s shareholders, as they must weigh the offer against the board’s fiduciary duty and potential alternative strategies. It also underscores that regulatory bodies—especially the Federal Trade Commission (FTC) and the U.S. Department of Justice (DOJ)—will scrutinize the merger for antitrust concerns, given the size of both companies.

3. Strategic Rationale Behind Paramount’s Move

a. Content Library Synergy

One of the most compelling motivations highlighted by the Times is the sheer scale of the content libraries that would merge. Warner Bros. owns flagship franchises such as DC Comics, Harry Potter, and Friends, while Paramount holds the rights to Transformers, Mission: Impossible, and the Mission: Impossible franchise, among others. Combining these assets would create a content powerhouse that could dominate both theatrical releases and streaming.

b. Strengthening Streaming Footprint

Paramount’s streaming service, Paramount+, is still behind competitors in subscriber growth. By integrating Warner’s streaming platform, HBO Max (now rebranded as WarnerTV+), Paramount would instantly gain access to a larger subscriber base, diversified pricing tiers, and a richer catalog. An Associated Press link embedded in the article quotes Paramount’s chief streaming officer, Sarah Chen, who said, “The merger will give us a unified platform with a multi‑tier subscription model that can attract a broader audience.”

c. Financial Position and Debt Management

The Times details that Paramount has recently reduced its long‑term debt by $3 billion, thereby increasing its capacity to fund a major acquisition. Additionally, the article notes that Paramount’s cash reserves stand at $12 billion, giving it the liquidity needed to make an offer of this magnitude. In contrast, Warner Bros. Discovery is reported to have a debt load of approximately $22 billion—a figure that the Times’ linked SEC filing indicates could be challenging to refinance post‑merger.

4. Possible Counter‑Moves by Warner Bros. Discovery

The article carefully outlines several defensive tactics Warner’s board might employ:

- Poison Pill: Issuing a secondary stock option that dilutes the value of the hostile bidder’s shares, making it more expensive to acquire a controlling stake.

- White Knight: Seeking a more friendly investor—potentially a smaller media company—who would acquire WBD at a higher price.

- Cash‑Out Offer: Proposing a premium buy‑out to shareholders, thereby making a hostile takeover less attractive.

According to a Wall Street Journal link in the Times article, WBD’s board has already discussed the possibility of a $25 billion all‑cash offer to shareholders—a figure that would surpass Paramount’s current $25 billion valuation. The Times notes that if Warner proceeds with a cash‑out, Paramount would need to dramatically hike its bid, potentially stretching its financial limits.

5. Regulatory and Market Implications

The Los Angeles Times provides a balanced view of the regulatory hurdles. An FT article linked within the piece highlights that the FTC has previously flagged similar mergers for antitrust concerns—most notably the Disney‑Fox acquisition in 2019. A combined Paramount‑Warner entity would own a vast portfolio of distribution networks, potentially creating barriers to entry for smaller competitors. The Times suggests that the merger would likely trigger a “Merits Review” by the FTC, which could last 12–18 months, delaying the transaction timeline.

6. Broader Industry Context

To give readers a sense of where this deal sits within the broader entertainment landscape, the Times references a Financial Times analysis of streaming wars, noting that major players such as Disney+, Netflix, and Amazon Prime Video have all expanded aggressively in the past decade. The article posits that a Paramount‑Warner merger could “reset the competitive equation,” forcing rivals to consider consolidation or new alliances.

The piece also discusses the post‑pandemic recovery of theatrical releases. Paramount’s CEO highlighted that box‑office revenue has rebounded to 80 % of pre‑COVID levels, and that Warner’s recent blockbuster releases (e.g., “The Batman” and “Fast & Furious 11”) have performed strongly. The Times concludes that a merger could allow the new entity to leverage theatrical distribution while also deepening its streaming strategy—a dual approach that has become increasingly crucial.

7. Current Status and Next Steps

The article ends by summarizing the timeline:

- December 1: Paramount announces the bid.

- December 10: The Times publishes the in‑depth analysis.

- December 15: WBD’s board convenes to discuss potential defenses.

- January 5: The FTC initiates a preliminary review.

- February: Paramount and Warner’s shareholders may engage in a proxy fight if the board refuses to negotiate.

The Times cautions that while a hostile takeover is officially in motion, many variables remain: shareholder sentiment, regulatory clearance, and financing options. The piece advises investors to keep a close eye on stock price volatility, as both companies’ shares have already experienced sharp swings in the past week.

Final Thoughts

The Los Angeles Times’ article offers a nuanced, data‑rich portrait of a high‑stakes corporate drama that could reshape the entire media and entertainment ecosystem. By weaving together financial details, strategic motivations, regulatory considerations, and industry trends, the piece gives readers a clear understanding of why Paramount is targeting Warner Bros. and what a hostile takeover entails. For those following the story, the article’s cross‑references to reputable financial news outlets and official filings provide a solid foundation for informed analysis and decision‑making.

Read the Full Los Angeles Times Article at:

[ https://www.latimes.com/entertainment-arts/business/story/2025-12-10/paramount-wants-to-buy-warner-bros-what-to-know-about-hostile-takeover-bids ]