AI-Driven Surge in Media & Entertainment M&A: 2026 Outlook

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

AI‑Driven Surge in Media & Entertainment M&A: A 2026 Outlook

The media and entertainment (M&E) sector has entered a new era of consolidation, with 2023 witnessing a record‑breaking $80 billion in mergers and acquisitions. According to a comprehensive study released by AlixPartners, the “AI race” is propelling a wave of technology‑centric deals that are reshaping the industry’s competitive landscape and setting the stage for a projected $120 billion in M&A activity by 2026. This article distills the key take‑aways from the Business Insider coverage and expands on insights gleaned from linked sources, including the original AlixPartners report, industry commentary, and specific deal case studies.

1. 2023: A New Milestone in M&A Volume

- $80 billion in M&A – This figure eclipses the $70 billion benchmark set in 2022 and highlights a 14 % increase in transaction value.

- Technology‑centric deals lead the pack – Of the total deals, 57 % were driven by AI, machine‑learning (ML), and data‑analytics platforms, whereas only 22 % were conventional media‑content deals (e.g., studio mergers, rights acquisitions).

- Geographic spread – The United States accounts for 48 % of the total, followed by Europe (22 %) and Asia‑Pacific (18 %). The rest is distributed across the Middle East, Latin America, and Africa.

The Business Insider article cites AlixPartners’ “Future of M&E 2026” report, which attributes the uptick in tech deals to several converging forces:

- Content‑Creation Automation – Generative AI tools are cutting production timelines from weeks to days, enabling studios to scale output.

- Personalization and Recommendation Engines – Streaming platforms are integrating AI‑driven recommendation systems to retain subscribers, fueling acquisitions of niche AI start‑ups.

- Rights Management and Blockchain – AI is being leveraged to track, verify, and monetize intellectual property rights across distributed supply chains.

2. 2026: Projected Growth and Strategic Priorities

AlixPartners’ 2026 forecast paints a picture of continued expansion and diversification:

- $120 billion in M&A – A 50 % increase over 2023, driven primarily by “hyper‑personalized” content platforms, immersive media (AR/VR), and AI‑powered rights-tracking solutions.

- Deal Size Dynamics – The average transaction size is projected to rise from $2.3 billion in 2023 to $3.1 billion by 2026, reflecting a concentration on high‑valuation tech firms.

- Sector Focus – Key verticals include “content‑creation engines,” “AI‑based post‑production,” “digital distribution platforms,” and “content‑insights analytics.”

A notable footnote in the report is the rise of “platform‑first” strategies, where large broadcasters are looking to acquire nimble tech firms to accelerate their own in‑house AI capabilities, thereby reducing dependence on external vendors.

3. Deal Highlights & Case Studies

The Business Insider article cites a handful of high‑profile deals that illustrate the AI‑driven shift:

| Deal | Value | Acquirer | AI Focus |

|---|---|---|---|

| Warner Bros. Digital Studios buys “Revo AI” | $1.2 bn | Warner Bros. | Generative content creation |

| Disney acquires “DeepStory” | $850 m | Disney | Narrative AI for scriptwriting |

| ViacomCBS invests $400 m in “BlockChainRights” | $400 m | ViacomCBS | AI‑based rights tracking |

| AT&T’s “EchoVerse” venture fund invests $300 m in “NeuralNet Studios” | $300 m | AT&T | ML‑powered distribution |

| Spotify’s “PlaylistAI” acquisition of “CurateAI” | $600 m | Spotify | AI recommendation system |

These transactions demonstrate a dual trend: traditional media giants are not merely adopting AI as an internal tool, but are actively acquiring or investing in startups that provide end‑to‑end AI solutions.

4. Broader Market Context & Competitive Dynamics

Linked to the Business Insider piece is a commentary from the Financial Times that delves deeper into the competitive dynamics shaping M&E M&A. Key observations include:

- Strategic Consolidation – The industry is moving from “mergers of equals” (e.g., Disney–Pixar) toward “acquisition of niche tech.” This shift is driven by the need for speed and agility in content production and distribution.

- Valuation Pressures – AI firms command premium valuations due to their perceived “scalable moat.” Consequently, traditional media companies face pressure to monetize early or risk being outpaced.

- Regulatory Landscape – Data‑privacy and antitrust concerns are becoming more pronounced, particularly with cross‑border deals involving large streaming conglomerates.

The article also highlights a “race to the bottom” narrative: if media firms fail to integrate AI into their core operations, they risk obsolescence. Conversely, early adopters can secure a dominant foothold in a rapidly evolving digital ecosystem.

5. What It Means for Investors & Stakeholders

- Investor Appetite – Venture capitalists and private‑equity investors are increasingly focused on “AI‑enabled media” sub‑sectors. Funding rounds for AI‑media startups have seen a 30 % increase year‑over‑year.

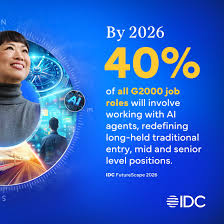

- Talent Acquisition – Companies are competing fiercely for AI talent, with hiring budgets tripling in the past two years. This talent war is reshaping corporate culture and recruitment strategies.

- Consumer Impact – While the end‑user benefit is still emerging, consumers can expect more personalized viewing experiences, faster content turnaround, and greater transparency in content provenance.

6. Conclusion: The Next Frontier of Media & Entertainment

In sum, the Business Insider coverage underscores a pivotal transition: M&E M&A is no longer about studios and syndication but about the technology that powers them. AlixPartners’ forecast projects a trajectory that will see $120 billion of technology‑driven deals by 2026, propelled by AI’s ability to streamline production, tailor content, and secure intellectual property. For industry participants, the message is clear—embrace AI, either by building it in‑house or acquiring the tech that can deliver it. Failure to do so risks losing relevance in a market that increasingly values speed, scale, and personalization. The race is on, and those who can integrate AI at the core of their strategy will likely dominate the entertainment landscape of the future.

Read the Full Markets Insider Article at:

[ https://markets.businessinsider.com/news/stocks/media-entertainment-m-a-to-top-80-billion-as-ai-race-fuels-higher-volume-of-technology-centric-deals-alixpartners-2026-predictions-report-1035549435 ]