ITV Mulls GBP2.1bn Sale of Media & Entertainment Arm to Comcast's Sky

TheWrap

TheWrapLocale: England, UNITED KINGDOM

ITV Eyes a £2.1 bn Deal with Comcast and Sky: What It Means for the UK and Global Media Landscape

The BBC‑owned ITV plc has been quietly courting a major buyer for its Media & Entertainment (M&E) arm, and a headline‑grabbing £2.1 bn ($2.7 bn) sale to Comcast’s Sky division is now the most credible possibility. A Reuters report that first broke the story was republished by MSN Entertainment, which added context and links to the companies involved. In what could be the most consequential media transaction in the UK for years, ITV would hand over the business that produces, markets and distributes a wide range of television content – from dramas and comedies to factual programmes – to a US‑based conglomerate that already owns a significant stake in Sky.

The Asset on the Table

ITV’s Media & Entertainment division is a sprawling portfolio of production, distribution and licensing businesses. At its core sits ITV Studios, the production house behind iconic series such as Downton Abbey, The Crown (through its partnership with BBC Studios) and The Great British Bake Off. The division also includes ITV Studios Global Business, the international arm that sells ITV’s catalogue to broadcasters, streaming services and cable operators worldwide. In short, the M&E unit is the creative and commercial engine that turns British TV into a global revenue stream.

The potential buyer, Comcast’s Sky, already operates Sky Group – a UK‑based satellite broadcaster and streaming service that is a major distributor of international content in the UK, Ireland and beyond. By acquiring ITV’s M&E arm, Sky would add a robust production pipeline to its distribution platform, potentially enabling it to produce original programmes that could be offered on its own streaming service, Sky Max, and to license content to other markets.

Why the Deal Makes Business Sense

Diversifying Sky’s Portfolio

Sky has been working to shift from a traditional pay‑TV model to a content‑centric one. While it has already been investing in original programmes through Sky Studios, the addition of ITV Studios would massively scale that effort, giving Sky access to a proven catalogue of hit shows and a deep catalogue of classic British series that have proven exportability.A Capital Boost for ITV

ITV’s free‑to‑air core (the ITV network) faces significant competition from streaming giants, ad‑supported platforms, and changing viewer habits. A sale of the M&E division would give ITV a sizeable injection of cash – roughly a third of the company’s annual turnover – that could be reinvested into its core broadcast business, used to pay down debt or to fund future investments.Strategic Counter‑Balance for U.S. Players

In a media environment increasingly dominated by U.S. conglomerates such as Netflix, Disney+ and Amazon Prime, a combined ITV‑Sky entity would be a formidable European competitor. With both production and distribution capabilities under one roof, the new group could produce high‑quality content that could be rolled out across multiple platforms, potentially challenging the dominance of U.S. streaming services in the UK and Europe.

The Competitive Landscape

The article also touches on the broader context of media consolidation in Europe. Sky already owns 30 % of the Sky Group, and the company is a subsidiary of Comcast, the U.S. telecommunications giant that also owns NBCUniversal. By merging with ITV’s M&E arm, Comcast would essentially be adding a major European production house to its already sizable portfolio of U.S. and international content.

Meanwhile, BBC Studios – the production arm of the BBC – is itself a significant competitor in the production and licensing arena, often partnering with ITV Studios to produce cross‑border projects. The deal could thus lead to a rare situation where the two biggest British broadcasters (ITV and the BBC) are sharing production assets on one side and competing on the other.

Regulatory Hurdles

While the deal appears financially attractive, it would need to clear UK competition authorities and regulators. The Competition and Markets Authority (CMA) and the Office of Communications (Ofcom) will scrutinise whether the merger would stifle competition in the broadcasting market. Past deals, such as BBC’s takeover of the production arm of the now‑defunct Channel 4’s UKTV**, were also subject to regulatory review.

Additionally, the European Commission may get involved, especially if the combined entity plans to expand beyond the UK into other European markets. The deal’s €2.1 bn price tag is well above the threshold for the EU’s Merger Regulation, triggering a mandatory review.

Historical Precedents

The article notes that ITV has a history of selling stakes in its production arm – for example, the 2015 sale of a 35 % stake in ITV Studios to MGM/United Artists (though that was a joint venture rather than a sale). ITV also previously sold a minority stake in its ITV Studios Global Business to Bam Margolin’s MGM**. These moves illustrate ITV’s willingness to partner with global content players to maximize revenue.

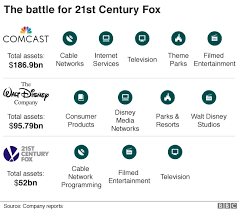

In the U.S., a similar pattern is evident: NBCUniversal’s acquisition of DreamWorks Animation (through its parent Comcast) and the recent Disney’s acquisition of 21st Century Fox highlight how large conglomerates consolidate production and distribution vertically.

Possible Outcomes

If the deal proceeds, there are a few likely scenarios:

Full Integration: ITV’s M&E would be fully integrated into Sky’s existing structure, with ITV Studios rebranded as Sky Studios. The combined catalogue would be marketed under a single banner, simplifying licensing and distribution processes.

Partial Integration: ITV retains its own branding for its production arm, but operates under a joint‑venture framework with Sky. This would preserve the ITV Studios brand, which carries significant goodwill among producers and audiences.

Retention of ITV’s Core: ITV could keep its free‑to‑air network, while the M&E sale would be a standalone transaction. The company would then operate as a “broadcast-only” ITV plc, with the media & entertainment operations handled by Sky.

Bottom Line

The proposed £2.1 bn sale of ITV’s Media & Entertainment arm to Comcast’s Sky is more than a simple corporate transaction. It could reshape the UK’s media ecosystem, create a powerful European content hub, and potentially alter the competitive dynamics between traditional broadcasters and streaming services. While regulatory hurdles loom, the strategic logic for both sides is compelling: ITV gains a needed capital infusion, while Sky adds a proven production engine that could accelerate its ambition to become a global streaming contender.

Only time will tell whether the deal goes through – but the headlines suggest that the conversation is moving beyond rumor into real negotiations, with the potential to alter the media landscape for years to come.

Read the Full TheWrap Article at:

[ https://www.msn.com/en-us/entertainment/tv/itv-in-talks-to-sell-media-entertainment-to-comcast-and-sky-for-2-1-billion/ar-AA1Q0gN0 ]