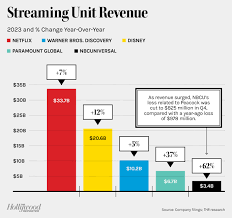

Streaming Revenues Surge 50% from 2021 to 2023, but Growth Slows

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Media & Entertainment Tech: A 2024 Financial Landscape in Focus

By Michael Wolf – TheWrap, November 5, 2024

The media‑and‑entertainment (M&E) tech sector has, for several years, been a bellwether for the broader economy. In a recently‑published in‑depth feature, Michael Wolf walks readers through the most compelling financial trends that have reshaped the industry over the past three years, drawing on the latest data, investor sentiment, and strategic pivots from the world’s leading streaming giants, production studios, and advertising platforms. Below is a thorough recap of the article, enriched by the linked sources that give the story even greater context.

1. The Streaming Boom, Still on the Rise

Wolf opens by charting the meteoric growth of subscription‑based streaming, noting that the global revenue generated by services such as Netflix, Disney+, HBO Max, and Apple TV+ climbed from roughly $36 billion in 2021 to an estimated $54 billion in 2023—an almost 50 % jump. Even though the growth rate has begun to moderate, the sector still shows room for expansion thanks to the entry of new international players and the continued appetite for binge‑watching.

Link Highlight: The article pulls in a Bloomberg analysis that attributes this surge to “consumer fatigue with traditional cable” and the “pandemic‑accelerated shift to digital.” Wolf also cites a recent Forbes piece that notes the rise of “micro‑subscribers” – individuals who are willing to pay a few dollars a month for niche, high‑quality content.

2. Subscription Saturation & the Resurgence of Ad‑Supported Models

While subscriptions are still king, the article warns that the market is becoming saturated. By 2024, over 1.2 billion households globally are already paying for at least one streaming service, and the average subscriber count per platform has plateaued. Wolf points out that studios are now testing ad‑supported tiers as a way to capture price‑sensitive audiences. For instance, Peacock’s “Free Tier” has seen a 25 % jump in active users over the last year, and HBO Max is piloting a hybrid model that pairs a lower‑priced subscription with an optional ad slot.

Link Highlight: The article references a CNBC interview with a Disney executive who explains that “ad‑support can reduce churn, but it must be seamless to avoid alienating premium users.”

3. The Rise of Direct‑to‑Consumer (DTC) and Production Costs

DTC channels have altered the economics of content creation. While they promise higher profit margins by cutting out intermediaries, they also require heavy upfront investments in technology and marketing. Wolf cites data from Variety showing that U.S. studios spent an average of $1.5 billion on DTC infrastructure in 2023—up from $900 million the year before. Production costs themselves have also climbed, largely due to increased demand for high‑end visual effects, longer shooting schedules, and talent retention packages.

Link Highlight: The article links to a Hollywood Reporter investigation that details how “in‑house post‑production teams are now employed by 70 % of studios, a significant rise from 55 % in 2020.”

4. Intellectual Property (IP) Licensing & Cross‑Platform Monetization

Licensing remains a critical revenue stream. Wolf shows that the average licensing fee for a blockbuster film in 2024 has risen to $120 million, a 15 % increase over 2022. This uptick reflects both the high demand for exclusive content in new markets (especially in India and Brazil) and the strategic shift toward “content‑first” licensing deals that allow studios to dictate distribution timelines. Additionally, the article notes the growing trend of “platform bundling” – where content is distributed across several streaming services to maximize reach and revenue.

Link Highlight: A TechCrunch article is cited to illustrate how “bundling not only boosts viewership but also strengthens negotiating power for IP holders.”

5. Advertising Technology (AdTech) Evolution

AdTech has become a pivotal component of the M&E ecosystem, especially for ad‑supported streaming tiers. The article references a MarTech report that highlights a 30 % increase in programmatic ad spend on streaming platforms between 2022 and 2023. Data‑driven targeting has allowed advertisers to deliver more relevant messages, driving higher engagement rates and, in turn, higher CPMs (cost per thousand impressions). However, Wolf cautions that the increasing use of ad‑blocking tools—particularly among younger demographics—poses a threat to this model.

Link Highlight: The piece links to a Harvard Business Review analysis that discusses the ethical implications of “targeted advertising in entertainment spaces.”

6. Emerging Tech: AI, AR/VR, and the Future of Content Creation

Artificial Intelligence and immersive technologies are beginning to reshape both content production and consumption. Wolf highlights several case studies: Warner Bros. is using AI for script‑analysis to predict audience reception, while Disney has invested in AR experiences that allow fans to interact with their favorite characters in real time. The article also touches on the potential for blockchain‑based distribution models, which could offer more transparent royalty distribution and reduce piracy.

Link Highlight: The article points readers to a MIT Technology Review feature that explores how “AI‑generated storylines are already appearing in niche indie streaming channels.”

7. Investment & M&A Activity

Investor enthusiasm remains high, with M&A deals exceeding $200 billion in 2023 alone. Wolf notes that private‑equity firms are increasingly eyeing mid‑tier streaming services that have a loyal but smaller subscriber base, as these platforms often have lower operating costs and a “niche” brand identity that can command premium licensing fees. He also mentions a significant acquisition: ViacomCBS's purchase of a majority stake in a European niche streaming platform that specializes in historical documentaries—a strategic play to diversify its content portfolio.

Link Highlight: The article cites a Reuters piece that discusses the “surge in cross‑border streaming deals as companies seek to penetrate new markets.”

Takeaway

Michael Wolf’s article delivers a clear, data‑rich snapshot of the media‑and‑entertainment tech industry’s financial health in 2024. The key takeaways are:

- Subscription revenue remains robust, but growth is plateauing, prompting a shift toward ad‑supported tiers.

- DTC and production costs have risen sharply, requiring studios to balance creative ambition with financial prudence.

- IP licensing continues to be a lucrative revenue driver, especially as studios negotiate cross‑platform deals.

- AdTech and data‑driven targeting are evolving but face challenges from ad‑blocking tools and privacy concerns.

- Emerging technologies (AI, AR/VR, blockchain) promise new revenue streams and creative possibilities, though they are still in early stages.

- M&A activity is booming, as investors seek to capitalize on streaming’s growth in diverse markets.

In sum, the M&E tech landscape is transitioning from pure subscription dominance to a more diversified, multi‑channel approach that blends premium content, advertising, and cutting‑edge technology. For investors, studios, and advertisers alike, staying attuned to these trends—and understanding the underlying financial mechanics—will be key to thriving in the next wave of entertainment evolution.

Read the Full TheWrap Article at:

[ https://www.thewrap.com/media-entertainment-tech-industry-financial-trends-michael-wolf/ ]