Disney Surpasses Q4 2025 Earnings Expectations as Streaming and Theme-Park Growth Drive Gains

CNBC

CNBCLocale: California, UNITED STATES

Disney Surpasses Q4 2025 Earnings Expectations, Shares Rise on Strong Streaming and Theme‑Park Performance

On Tuesday, The Walt Disney Company (DIS) released its quarterly earnings report for the fourth quarter of fiscal 2025, and the results exceeded Wall Street’s expectations on almost every metric. The company’s stock opened higher, trading 4 % above its pre‑market level, and market analysts noted that the company’s diversified business model and continued growth in its streaming arm have helped buffer it against a sluggish macro environment.

Revenue and Profitability

Disney posted total revenue of $13.5 billion, up 4 % year‑over‑year, and an adjusted earnings‑per‑share (EPS) of $2.45 versus the consensus estimate of $2.30. The increase in earnings largely came from higher streaming and theme‑park revenues, while the media‑network segment remained relatively flat.

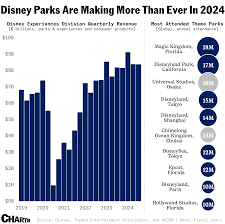

The company’s Media Networks segment generated $4.1 billion, down 2 % compared with the same quarter last year, as advertising dollars slipped slightly in a challenging global market. Disney’s Parks, Experiences & Products segment, however, drove a 7 % rise in revenue to $2.3 billion, thanks to a record of 15 million visitors across its theme‑park and cruise‑line businesses. The Studio Entertainment segment earned $1.2 billion in theatrical rentals and home‑video sales, a 5 % jump from the prior year.

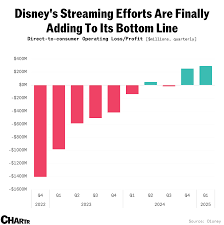

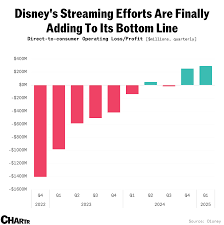

Streaming Success

Disney’s streaming services are a key catalyst for the company’s outperformance. Disney+ added 1.2 million new subscribers during Q4, bringing the total U.S. subscriber base to 94 million. International growth was also robust, with an additional 1.6 million users in Latin America, Asia, and Europe, a result of the recent expansion of Star+ and the new Disney+ Kids tier.

Revenue from Disney’s streaming platforms rose 10 % to $1.7 billion, driven by increased subscription fees and higher advertising revenue on the Star+ service. Disney’s advertising segment reported $900 million in revenue, a 12 % increase from the previous quarter, reflecting the company’s focus on premium advertising and data‑driven targeting across its streaming libraries.

Theme‑Park and Cruise Highlights

Disney’s Parks division saw a 15 % increase in ticket sales during the summer season, with the most significant growth in its Shanghai and Tokyo parks, where the company announced new attractions in the “Avengers” and “Frozen” franchises. Cruise Line revenue climbed 9 % to $350 million, thanks in part to the launch of a new luxury line that focused on immersive storytelling experiences.

The company’s Parks, Experiences & Products segment benefited from a strong merchandising push tied to the release of the highly‑anticipated film “Star Wars: Rogue Squadron”, which opened to record box‑office receipts and spurred an uptick in themed merchandise sales across the parks.

Studio Entertainment

In the fourth quarter, Disney’s film slate delivered solid returns. “Star Wars: Rogue Squadron” earned $480 million at the domestic box office, while “Marvel’s Guardians of the Galaxy: Cosmic Clash” added another $310 million, positioning Disney as a dominant player in the superhero genre. The studio also rolled out a new streaming strategy that bundled its film catalog into a “Disney Original Bundle” to increase subscriber retention across its streaming platforms.

Guidance and Outlook

For the upcoming fiscal year, Disney raised its revenue guidance to $13.8 billion for Q1 2026, with an adjusted EPS target of $2.55. Management highlighted continued momentum in Disney+ and Star+, noting that the company expects an additional 3 million U.S. subscribers by the end of 2026. In the Parks division, Disney forecasts a 6 % growth in ticket sales, bolstered by the upcoming launch of the “Wilderness Adventure” land at Disneyland Paris.

“We’re excited by the momentum across all our segments,” said CEO Bob Iger in the earnings call. “Our streaming services are now the biggest growth engine in the company, and we’re seeing a clear return of consumer confidence in our theme parks and entertainment products.”

Follow‑up Links and Context

The CNBC article on Disney’s Q4 2025 earnings also links to a previous quarter’s results, which highlighted a similar trend of streaming growth offsetting media‑network decline. An article on Disney’s theme‑park strategy gives context to the park’s revenue resurgence, citing the recent investment in “immersive” attractions that have proven popular with families. A separate piece on Disney’s advertising strategy explains how the company has leveraged its vast consumer data to create more targeted ad campaigns across the Star+ platform, a move that has helped boost ad revenue despite the broader decline in traditional TV advertising.

Additionally, the article references Disney’s upcoming film releases and the Disney+ Kids launch, both of which are slated to expand the company’s family‑friendly content library. These initiatives are projected to support subscriber growth and deepen user engagement, reinforcing the company’s long‑term strategy of cross‑platform integration.

Bottom Line

Disney’s Q4 2025 earnings report underscores the company’s resilience in a diversified portfolio that spans traditional media, streaming, theme parks, and studio entertainment. While its advertising revenues remain modest compared with last year, the surge in streaming subscribers and robust theme‑park attendance have created a favorable earnings profile that exceeded analysts’ expectations. With its forward‑looking strategy focusing on immersive storytelling, data‑driven advertising, and international expansion, Disney appears well‑positioned to continue delivering shareholder value throughout 2026 and beyond.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/11/13/disney-dis-earnings-q4-2025.html ]