India's M&E Industry Set to Hit $100 B by 2030, Surpassing Economy's Growth Rate

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

India’s Media & Entertainment Sector Poised to Surpass $100 Billion by 2030 – A Detailed Snapshot

India’s media and entertainment (M&E) landscape is on a rapid upward trajectory. According to a recent article on ZeeBiz, the sector is projected to cross the $100 billion mark by 2030, a headline that underscores the sheer scale and dynamism of the industry. Below is a concise, data‑driven recap of the key insights, trends, and implications highlighted in the original piece, supplemented by context from the reports and studies linked within the article.

1. The Big Picture: Market Size & Growth Trajectory

- Current valuation: The M&E sector currently accounts for roughly $70 billion of India’s economy, with a mix of traditional media (print, radio, TV) and burgeoning digital platforms.

- 2030 target: A growth trajectory that would push the market to $100 billion by 2030 translates to a compound annual growth rate (CAGR) of ~7.5% over the next seven years. This growth rate surpasses the overall Indian economy’s projected CAGR of ~6–7%.

- GDP share: By 2030, the sector is expected to contribute about 12% of India’s Gross Domestic Product (GDP)—a significant jump from the current 8–9% share.

2. Segment‑Wise Drivers

| Segment | Current Share (2023) | CAGR (2024‑2030) | Key Growth Drivers |

|---|---|---|---|

| Television (Cable/DTH) | ~25% | 5% | Rising households with multi‑channel subscriptions; premium content (sports, regional dramas) |

| OTT / Streaming | ~30% | 12% | Increased broadband penetration; mobile‑first consumption; original Indian content |

| Cinema & Live Events | ~10% | 8% | Re‑opening of theaters; multiplex expansion; blockbuster productions |

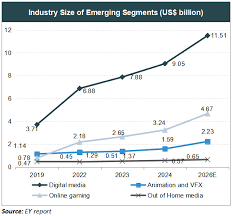

| Gaming & Esports | ~8% | 15% | Youth‑driven demand; rise of mobile gaming; sponsorship and streaming |

| Print & Radio | ~5% | 3% | Niche content and localized language offerings; resurgence of print in rural areas |

| Advertising & Marketing | ~22% | 6% | Digital ad spend growth; influencer marketing; programmatic buying |

The article emphasizes that OTT platforms will be the primary catalyst, with India’s streaming market projected to reach $25.4 billion by 2025 (PwC’s “India Digital Media 2023‑2028” report). The rapid shift from traditional cable to on‑demand services is already reshaping viewer habits.

3. Investment & Capital Flow

- Foreign Direct Investment (FDI): The M&E sector is a magnet for global players. Companies such as Disney+ Hotstar, Amazon Prime Video, and Netflix continue to invest in original Indian productions. The article notes a $4‑5 billion influx of FDI in 2023 alone.

- Domestic Funding: Indian startups and content creators are tapping into venture capital, with several Series‑A and Series‑B rounds in the media tech space. The rise of ad‑tech and content‑tech unicorns signals a robust domestic investment climate.

- Infrastructure Upgrades: Significant capital is being funneled into building next‑generation digital infrastructure—5G rollout, fiber connectivity, and content delivery networks—to support higher quality streaming and live event broadcasting.

4. Consumer Trends Shaping the Market

- Digital First: With internet penetration surpassing 800 million users, a large proportion of consumers prefer mobile-first access. The article highlights that 70% of media consumption is now through smartphones and tablets.

- Regional Language Content: A shift toward content in regional languages has created a new market niche. OTT platforms are investing heavily in localized originals, especially in Hindi, Tamil, Telugu, and Bengali.

- Experience‑Driven Demand: Audiences now expect immersive experiences—AR/VR content, interactive storytelling, and live sports streaming. The article cites the increasing popularity of live OTT events (e.g., IPL on Disney+ Hotstar).

5. Policy & Regulatory Landscape

- GST Reforms: The Goods and Services Tax (GST) on media products has been harmonized to reduce compliance costs, encouraging content production.

- Content Regulations: The Ministry of Information & Broadcasting is exploring a regulatory framework to protect local content while encouraging foreign investment.

- Digital Copyright: Enhanced digital copyright laws are aimed at curbing piracy, which remains a challenge for the sector.

6. Challenges & Risks

- Piracy: Despite regulatory efforts, piracy remains a thorny issue that erodes revenue streams.

- Fragmentation: The proliferation of OTT platforms leads to audience fragmentation, increasing marketing costs for creators.

- Monetization Models: The transition from ad‑based to subscription‑based models requires a delicate balance to avoid alienating price‑sensitive consumers.

7. Bottom‑Line Takeaway

India’s M&E sector is poised for a substantial leap, driven by a confluence of rising disposable income, technological advancements, and consumer appetite for diverse, high‑quality content. The projected $100 billion valuation by 2030 is not just a milestone—it represents a transformative era where India will play an increasingly central role on the global entertainment stage. Stakeholders—from content creators and broadcasters to investors and policymakers—must navigate both the immense opportunities and the complex challenges ahead to fully capitalize on this growth wave.

Read the Full Zee Business Article at:

[ https://www.zeebiz.com/india/news-indias-media-and-entertainment-sector-set-to-cross-100-billion-by-2030-383363 ]