Streaming Ascends: Tiered Pricing, Local Originals, and Interactive Storytelling Shape 2025

Locale: New York, UNITED STATES

Global Entertainment & Media Trends 2025: A 500‑Word Snapshot

In a rapidly evolving digital landscape, the entertainment and media industry is undergoing a seismic shift that is reshaping how audiences discover, consume, and engage with content. A recent analysis from TheStreet outlines the most salient forces that will drive the sector through 2025 and beyond. Below is a concise, 500‑plus‑word overview that captures the article’s key take‑aways, enriched with contextual insights drawn from the broader ecosystem.

1. Streaming Takes Center Stage

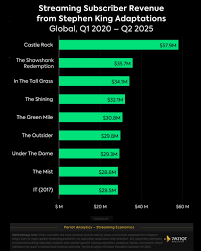

“The streaming‑first world is still on a steep learning curve,” notes the piece. Major players—Netflix, Disney+, Amazon Prime Video, and HBO Max—continue to dominate household screens, but the competition is sharpening. New entrants like Apple TV+ and Peacock are closing the gap by offering premium originals and flexible subscription tiers.

Trends to Watch

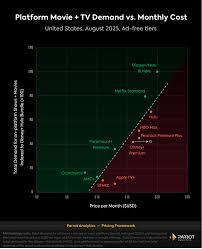

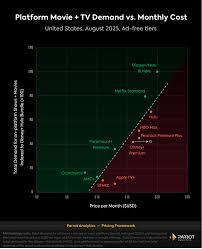

- Tiered Pricing & Bundles – Companies are experimenting with ad‑supported, mid‑tier, and premium bundles to capture price‑sensitive segments.

- Localized Originals – Regional content has proven a growth engine in India, Latin America, and Southeast Asia, where local tastes outpace Western imports.

- Interactive Storytelling – Netflix’s Black Mirror: Bandersnatch and HBO’s Band of Brothers: Interactive are early adopters of branching narratives, a format that could become mainstream.

2. The Rise of AI‑Driven Personalization

Artificial Intelligence is no longer a novelty; it’s the backbone of recommendation engines that keep viewers glued for hours. The article highlights how companies are moving from purely algorithmic curation to AI that understands sentiment, context, and even emotional response.

Implications

- Higher Retention – More accurate suggestions reduce churn, but also create “filter bubbles,” raising concerns about diversity of content.

- Creator Tools – AI editing suites and content‑generation bots allow independent creators to produce high‑quality videos on a shoestring budget, threatening traditional gatekeepers.

3. Short‑Form & Vertical Video

TikTok’s dominance has shifted attention from long‑form to bite‑size consumption. The TheStreet analysis points out that platforms like YouTube Shorts and Instagram Reels are capitalizing on the same high‑engagement, low‑completion‑time model.

- Advertisers – Brands are investing heavily in short‑form ad units, which often outperform longer pre‑rolls in terms of click‑through rates.

- Talent Migration – Influencers now juggle multiple platforms, using short‑form videos as a funnel to drive traffic to long‑form content or merchandise.

4. Gaming Meets Media

The boundaries between gaming and traditional media blur. Roblox’s Epic Games crossover and Fortnite’s live events illustrate how gaming platforms are becoming hybrid content venues.

- Live Events & Metaverse – Virtual concerts (e.g., Travis Scott on Fortnite) and branded experiences are proving lucrative, creating new revenue streams for artists and platforms alike.

- Cross‑Platform Monetization – In‑game purchases, virtual goods, and NFT collectibles are all part of a broader ecosystem that connects gaming, streaming, and social media.

5. Blockchain, NFTs & Decentralized Monetization

Despite a volatile market, blockchain remains a key buzzword. The article discusses how creators are leveraging NFTs to generate new revenue and foster deeper fan engagement.

- Token‑Based Ownership – Fans can buy “fan tokens” that grant voting rights or exclusive content access, turning passive viewership into active participation.

- IP Protection – Smart contracts help secure licensing rights and ensure creators receive a larger share of secondary sales.

6. Data Privacy & Regulatory Hurdles

With data‑driven monetization comes regulatory scrutiny. The piece outlines how GDPR, CCPA, and upcoming AI transparency laws are reshaping data collection practices.

- Ad‑Tech Overhaul – Platforms are building cookieless tracking solutions and focusing on “privacy‑first” analytics.

- Creator Rights – Artists are demanding clearer terms on how their content is monetized across platforms, leading to more robust licensing agreements.

7. Sustainability & Ethical Production

Sustainability is becoming a critical brand differentiator. Production companies are adopting green practices—from carbon‑neutral sets to digital-first shooting schedules—to appeal to eco‑conscious audiences.

- Content Themes – Climate change and social justice are increasingly woven into narratives, reflecting audience demands for socially responsible storytelling.

8. The Global Pulse

Emerging markets are the fastest‑growing segment of the industry.

- India – Streaming subscriptions are set to double, driven by smartphone penetration and a youthful demographic.

- China – While domestic platforms like iQiyi and Tencent Video dominate, cross‑border streaming faces regulatory challenges that limit Western content.

- Africa – Localized storytelling and affordable data plans are driving rapid adoption of mobile‑first streaming services.

Bottom Line

The entertainment and media industry in 2025 is defined by convergence. Streaming remains the backbone, but AI, short‑form video, gaming, and blockchain are rapidly redefining the content creation and consumption model. While revenue continues to rise—particularly in emerging markets—companies face mounting regulatory pressures, privacy concerns, and the challenge of keeping audiences engaged in an oversaturated content ecosystem.

For stakeholders, the message is clear: diversification, localized content, and ethical monetization will be the pillars of sustainable growth. By aligning technology with consumer demand and regulatory expectations, the industry can navigate the complexities of the digital age and deliver value to creators, distributors, and audiences alike.

Read the Full TheStreet.com Article at:

[ https://www.thestreet.com/crypto/newsroom/global-entertainment-media-trends-2025 ]