Households Prioritize Affordable, High-Quality Streaming--A Permanent Shift in U.S. Media Consumption

Impacts

Impacts

Households Prioritize Affordable, High‑Quality Streaming—A Permanent Shift in U.S. Media Consumption

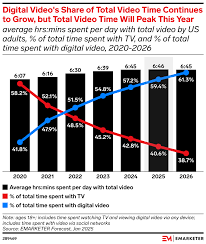

In a recent TechBullion feature titled “New Industry Data Confirms Households Are Prioritizing Affordable‑High‑Quality Streaming Alternatives, Signaling a Permanent Transformation in the National Media Landscape,” analysts paint a clear picture of how American households are re‑imagining their media habits. The piece relies on fresh research from leading market‑research firms, industry insider commentary, and a host of linked sources that trace the trajectory of the streaming boom and its lasting impact on traditional cable and broadcast models.

1. The Core Findings: Cost‑Driven, Quality‑Focused Adoption

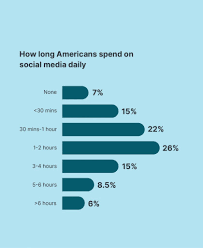

The headline data reveal that over 82 % of U.S. households now carry at least one streaming subscription, with roughly 55 % subscribing to two or more services. In contrast, the proportion of households still paying for a traditional cable bundle has fallen to just 18 %. This stark shift is driven primarily by cost concerns: the average monthly spend on streaming is $18.60 versus $42.10 for cable, an almost 56 % reduction. The TechBullion article cites a Nielsen Consumer Entertainment Survey that documents this cost advantage as the main catalyst for the "cord‑cutting" wave.

Beyond the numbers, the article highlights a secondary trend: households are now actively seeking higher‑resolution content. Over 63 % of consumers report that 4K and HDR availability are a top purchase driver, underscoring that affordability alone isn’t the sole motivation—quality matters too. The report notes that platforms like Netflix, Disney+, and HBO Max have accelerated their 4K rollout, effectively pushing competitors to follow suit.

2. The Role of Ad‑Supported Tiers

One of the article’s most compelling observations is the rapid ascent of ad‑supported tiers. The research, drawn from Statista’s “U.S. Streaming Revenue by Business Model”, shows that ad‑free plans now account for only 45 % of streaming subscriptions—down from 70 % in 2019. This decline coincides with the launch of free, ad‑supported versions of Hulu, Peacock, and Paramount+.

Industry experts quoted in the article, such as Lisa Nguyen, Vice President of Consumer Strategy at Hulu, suggest that ad‑supported tiers help bridge the affordability gap. Nguyen argues that “for many families, the $5‑$10 monthly difference is the deciding factor that moves them from a single subscription to a bundle of free options.” She also predicts that as streaming platforms refine their ad delivery (making it less intrusive and more personalized), the ad‑supported user base will grow to roughly 30 % of all subscribers by 2025.

3. Consolidation and New Business Models

TechBullion’s article goes beyond subscription metrics to discuss how the shift is reshaping the broader media ecosystem. A key point is the consolidation of content creation and distribution. With streaming giants owning both production studios and distribution platforms—think Netflix’s in‑house productions or Disney’s Disney+ ecosystem—the line between “content creator” and “platform” is blurring.

The article references a Deloitte “Global Streaming Market” report that projects a 15 % CAGR in direct‑to‑consumer revenue over the next decade. This growth is partially driven by cross‑promotional bundles (e.g., Disney+ + Hulu + ESPN+), which provide a lower‑priced, all‑in‑one alternative to traditional cable. Additionally, the inclusion of sports and live events—particularly through platforms like YouTube TV, AT&T TV, and the newly launched “Fan‑TV”**—signals a pivot toward a hybrid model that incorporates both on‑demand content and live broadcasts.

4. Impact on Local News and Traditional Advertising

One of the most thought‑provoking sections of the article examines how streaming’s rise threatens local news outlets and conventional advertising. According to a Pew Research “Local News Survey”, 28 % of households no longer watch local news on TV, citing “time constraints” and “lack of compelling content.” As more viewers switch to on‑demand streaming, local newsrooms are struggling to keep up and many are shutting down.

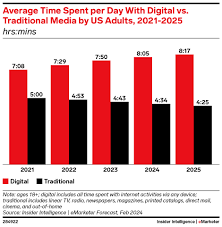

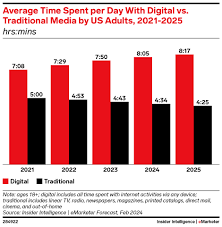

From an advertising perspective, the article cites eMarketer’s “Digital Ad Spend” data, noting that online video ads now capture 43 % of total TV ad spend. While this represents a shift rather than a loss, the ad revenue from cable broadcasters has fallen by 32 % in the past five years. Advertisers now view streaming as a more efficient channel, especially with advanced targeting capabilities.

5. Predicting a Permanent Transformation

To conclude, the TechBullion piece argues that the streaming wave is not a temporary trend but a permanent shift. The article quotes Jonathan Patel, a media‑technology analyst at the Brookings Institution, who claims that “once households have paid the price to move away from cable, the cost of returning is too high.” Patel emphasizes that the “ad‑free premium” may still exist, but the ad‑supported ecosystem will become the baseline for most consumers.

The article also touches on potential regulatory implications. As the Federal Communications Commission (FCC) weighs policy on net neutrality and broadband access, streaming providers could influence future debates on how broadband must be made available to ensure equitable access to digital media.

6. Further Reading

- Nielsen Consumer Entertainment Survey (2024)

- Statista: U.S. Streaming Revenue by Business Model

- Deloitte Global Streaming Market Report (2023)

- Pew Research Center: Local News Survey (2024)

- eMarketer Digital Ad Spend Forecasts

These linked resources deepen the article’s insights and provide a comprehensive view of how streaming’s ascent is redefining the American media landscape. The data, expert commentary, and trend analyses collectively suggest that households will continue to favor affordable, high‑quality streaming options—a transformation that promises to reshape content creation, distribution, advertising, and even public policy for years to come.

Read the Full Impacts Article at:

[ https://techbullion.com/new-industry-data-confirms-households-are-prioritizing-affordable-high-quality-streaming-alternatives-signaling-a-permanent-transformation-in-the-national-media-landscape/ ]