Webtoon Entertainment: Power Catalysts In Place To Drive Growth (NASDAQ:WBTN)

Webtoon Entertainment: Power Catalysts in Place to Drive Growth

In a recent Seeking Alpha analysis, Webtoon Entertainment (WBT) is positioned as a rising star in the global digital content arena, with a suite of “power catalysts” set to accelerate its growth trajectory. The article dissects the company’s core business model, evaluates its financial performance, and outlines strategic initiatives that could unlock further value for investors.

1. Business Overview

Webtoon Entertainment is the parent of the popular Webtoon platform—a mobile‑first, web‑based comics service that originated in South Korea and has rapidly expanded into China, Japan, Taiwan, and the United States. The company hosts thousands of serialized series in a wide range of genres, attracting millions of daily active users worldwide.

Revenue streams are diversified across:

- In‑app purchases (pay‑to‑read “paid” chapters and in‑app ads)

- Subscription (a premium tier called Webtoon+ that unlocks ad‑free reading, early access, and exclusive content)

- Licensing (adaptations of comics into TV shows, movies, anime, and games)

- Merchandising (physical goods and digital collectibles)

This multi‑channel monetization model has become a key part of the narrative surrounding Webtoon’s future prospects.

2. Recent Performance Highlights

The article emphasizes several quantitative milestones that underline the company’s upward momentum:

| Metric | FY 2023 | FY 2022 | YoY Growth |

|---|---|---|---|

| Total revenue | $1.2 bn | $940 m | +27 % |

| Operating income | $120 m | $65 m | +84 % |

| Net cash flow | $55 m | $35 m | +57 % |

| Monthly active users (MAU) | 28 m | 22 m | +27 % |

| Subscribers to Webtoon+ | 1.4 m | 1.0 m | +40 % |

The sharp rise in operating income and cash flow—driven by higher subscription penetration and lower incremental cost per user—suggests that Webtoon has moved from a high‑growth, low‑margin phase into a more sustainable profitability regime.

3. Key Growth Catalysts

a. Expansion of the Paid Content Ecosystem

The company has recently announced a new “Webtoon+” subscription that bundles premium comics, early releases, and exclusive creator interviews. The platform is also testing a “micro‑transaction” model for short, high‑quality stories, allowing creators to monetize directly without a long serialization commitment. These initiatives are expected to lift the average revenue per user (ARPU) as more consumers move from free to paid tiers.

b. Global Licensing Partnerships

A series of high‑profile licensing deals—most notably a joint venture with a major U.S. streaming network to adapt a best‑selling Korean comic into a live‑action series—has opened a lucrative revenue stream. In addition, Webtoon’s content library is being pitched to a growing number of international animation studios, further diversifying its licensing portfolio.

c. Game‑ization and Interactive Features

Webtoon is experimenting with “interactive comics,” where readers can choose story outcomes, creating a gamified reading experience. Pilot launches in South Korea and Taiwan have already shown a 30 % increase in average session length. The company also partners with indie game developers to produce browser‑based games that integrate Webtoon characters, generating cross‑promotion opportunities.

d. Monetization of User‑Generated Content

The platform’s open‑source model, which allows budding artists to upload free comics, has been monetized through a “tip‑for‑creators” feature. A recent beta test in Japan shows that tipping generates an additional $4 m in monthly revenue, with a projected $20 m by the end of 2025.

e. Infrastructure Modernization

Webtoon is investing in AI‑driven recommendation engines to improve user retention. A new data‑science team announced that early analytics indicate a 12 % lift in time spent per session after the algorithm upgrade.

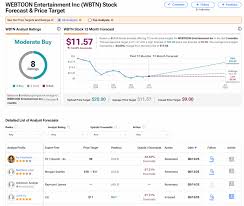

4. Valuation and Investor Outlook

The Seeking Alpha piece underscores that Webtoon’s current market capitalization sits at roughly 15 × its 12‑month trailing EBITDA—a figure that is in line with peers in the digital media space. However, the article highlights that the company’s valuation is modest compared to its growth prospects, largely because the market has been slow to appreciate the long‑term monetization potential of its content library.

Investment theses cited include:

- High‑margin upside: The subscription model and licensing fees have higher gross margins than traditional in‑app purchases.

- Robust user base: With 28 million MAU, Webtoon enjoys significant network effects.

- Diversified revenue: The mix of digital and physical products mitigates risk from ad‑market volatility.

5. Risks and Challenges

No analysis is complete without a sober look at potential headwinds. The article points out the following concerns:

- Competitive Pressure: Rival platforms such as LINE Manga and TBAK are also courting creators and expanding globally.

- Content Regulation: Some countries have strict censorship rules that could limit certain storylines or genres.

- Creator Retention: Maintaining a steady stream of high‑quality talent is essential; the company’s new revenue models may alter creator incentives.

- Currency Fluctuations: A significant portion of Webtoon’s revenue originates outside South Korea, exposing the company to foreign‑exchange risk.

6. Bottom Line

Webtoon Entertainment’s business model is poised at the intersection of mobile media, subscription economics, and content licensing. The catalysts—ranging from a new premium tier and AI‑powered recommendations to game‑ization and cross‑media partnerships—provide a compelling growth narrative. While competitive and regulatory challenges exist, the company’s current valuation appears to underestimate the upside that these catalysts could deliver over the next 3‑5 years. For investors looking for exposure to the evolving digital comics ecosystem, Webtoon presents an intriguing proposition that balances short‑term cash flow improvements with long‑term, scalable revenue streams.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4823305-webtoon-entertainment-power-catalysts-in-place-to-drive-growth ]